The Evolving World of Conversational Banking

We live in a world where simply having access to information is no longer good enough. You must also be able to get at that information quickly and easily. The good news? This is something that is increasingly possible due to conversational assistants. To see what I mean, just take a look at the banking industry.

Not that long ago, if you lost your debit card, you’d call up your bank, get transferred from department to department, and have to painstakingly share the same basic information over and over again until the situation finally got resolved. It was a frustrating experience for customers and one that wasted valuable bank resources. Today, by contrast, conversational assistants allow you to get information and resolve problems quickly and easily, whether you want to replace a lost card, apply for a loan, or understand if you’re saving enough for retirement.

That’s important because not only does it enable companies — whether banks or otherwise — to create better experiences for their customers, but it also helps them dramatically reduce the costs associated with maintaining large customer service teams.

So how did we get here? Let’s take a look at five trends that have paved the way for conversational banking.

1. There’s been an explosion of data.

Today’s software companies have access to vast amounts of data. Whether that’s consumer data they purchase from third parties or customer data they collect themselves, it’s raw input that can be harnessed to build more powerful AI solutions. Finn AI is a great case in point. We currently have over half a million distinct utterances compared to just 20,000 a year ago. This increase in data enables us to make our conversational banking assistants smarter and more effective, while also giving them new functionality.

2. Improved machine learning models have emerged.

Over the past five years, deep learning has re-emerged in a big way. From companies like Tesla, Google and others developing self-driving cars, to social media platforms like Facebook using image recognition to identify who’s in your pictures without being told, deep learning models have exploded in their use in production. By evolving from a statistical approach to machine learning to one that’s built around neural networks, we’ve been able to achieve a big improvement in performance. In our case, for example, it has allowed us to develop a much better understanding of what consumers want when they’re engaging with their banks, allowing our conversational assistants to respond appropriately without much need for human oversight.

3. The rise of deep learning for named-entity recognition.

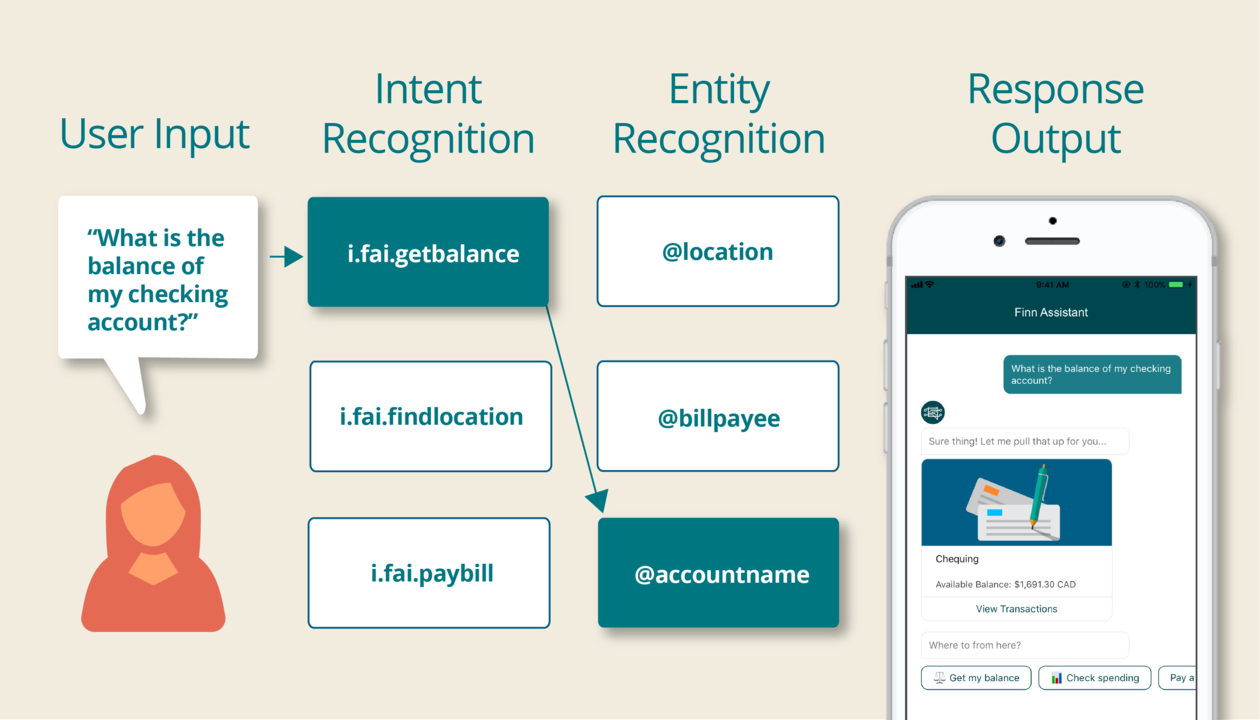

Thanks to deep learning techniques, named-entity recognition has also improved greatly in the past few years. It’s much easier to categorize information into names, locations, expressions of time, quantities, monetary values, and other entities. This is valuable because it simplifies the task of understanding and responding to people’s questions. Rather than create an answer to every possible phrasing of every conceivable question, named-entity recognition can reduce the need for individual intents and instead uses the smart detection of entities to identify the most precise answer to a question. This requires a much smaller set of responses, which in turn drives greater efficiency and accuracy.

4. The advent of reliable machine translation.

Machine translation has come a long way in recent years. In fact, according to some of our own internal work, we’ve found that Google Translate is 99 percent effective at translating content from English to Spanish. Progress like this means that it’s very easy to train bots in other languages while avoiding the classic cold-start problem of not having enough data. As a result, it’s easy to get a bot up and running in most languages quickly and easily.

5. A new focus on conversational design.

By far the most important change has been the new focus we’re seeing on conversational design. This trend incorporates all of the others that I’ve mentioned thus far and builds on them to enhance customer experience. It’s about designing conversational experiences that are tailored to your specific audience, taking their needs, demographic information, preferred channels, and other information into account. With good conversational design, you can iterate on your bot to meet the needs of your audience over time. The result should be a high-performing conversational assistant that not only gives customers what they’re looking for, but also delivers an outstanding, differentiated experience to each of them.

Better Banking Through Conversation

There have been a number of developments in recent years that have paved the way for chatbots to become an integral part of how businesses communicate with their customers. Going forward, the adoption of conversational AI in banking and other industries is only going to accelerate. To be successful in the AI-led world of tomorrow, it’s important that you get ahead of this trend and start integrating it within your business now.

Dr en sciences du langage qui modélise vos usages avec ou sans outils d’IA. Scribe et causeuse à ses heures perdues !

5ynice patterns…

Co-founder en Linguistic Factory

5yDo you handle negation and double intent?

Managing Director - Researcher Hub Healthcare

5yGreat, very interesting. We recently worked on a Proof of concept base on IBM Watson API : http://www.napal-innovation.xyz/en/ the ML + Rule based approch is really nice to build topic specific bot.

General Manager at Rahi

5yThere are always new trends and practices in all industries using advanced technologies, but I really enjoyed reading this!